Revenue Detail Report

Reporting → Financials

Purpose

Need the nitty‑gritty? Revenue Detail is the line‑item ledger of every charge in your system—donations, tuition, merchandise, you name it—mapped to the right GL Account & Fund. Use it to:

- Reconcile deposits against accounting.

- Filter by Fund for donor‑restricted reporting.

- Spot failed or refunded payments fast.

Anatomy of the Report

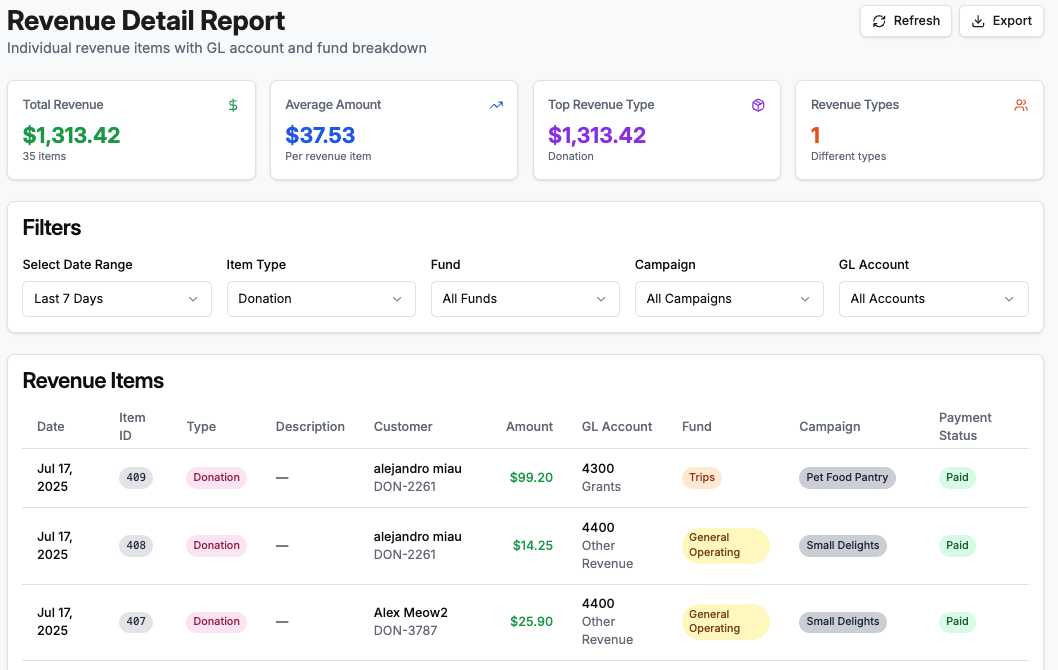

| # | Section | What It Shows |

|---|---|---|

| 1 | Filters | Date Range picker (Today, Last 7 Days, MTD, Custom, etc.) plus: • Type (Donation, Purchase, Fee, etc.) • Fund selector • GL Account selector • Payment Status (Paid, Pending, Failed, Refunded). |

| 2 | KPI Cards | • Total Charges (count) • Gross Amount (sum of positives) • Refunds / Reversals (sum of negatives) • Net Revenue (Gross − Refunds). |

| 3 | Revenue Detail Table | One row per charge with columns: • Date – local timestamp. • Type – Donation, Purchase, Fee, etc. • Customer – name + ID (click to open profile). • Amount – currency; refunds show red/negative. • GL Account – code & name. • Fund – badge showing Fund tag. • Payment Status – Paid, Partially Paid, Pending, Failed, Refunded. |

| 4 | Actions | Refresh to rerun the query, Export to CSV/Excel. |

How the Numbers Are Calculated

- Gross Amount = Sum of positive charge amounts in the filtered set.

- Refunds / Reversals = Sum of negative charges (credits, refunds).

- Net Revenue = Gross Amount − Refunds.

Tip: Want to see only money actually received? Add a Payment Status = Paid filter.

Running the Report – Step‑by‑Step

- Navigate → Financials → Reports → Revenue Detail.

- Choose a Date Range and any optional filters (Type, Fund, GL Account, Payment Status).

- Click Refresh (runs automatically when filters change).

- Review KPI Cards for a quick snapshot.

- Scroll or Search (

Ctrl/⌘ + F) the table for specific charges. - Export if needed for auditors or spreadsheet power‑users.

Power Tips

- Drill‑Down from Revenue Summary – Click any revenue account in Revenue Summary to open this report pre‑filtered for that GL Code.

- Zero Rows Hidden – Charges with $0 or voided balances are hidden by default; toggle Show Voids to include them.

- Link‑Out – Click the Customer to open their profile or Invoice ID (coming soon) for full context.

FAQ

Why don’t I see expenses here?

Revenue Detail is income‑only. Expense tracking is coming with the Expense & Budget Tracking release.

Does this include offline cash/check gifts?

Yes—any recorded charge, whether processed online or entered manually, appears here.

How do I match this to my bank deposits?

Use Payment Status = Paid and match Gross or Net (depending on fees) to your payout reports. For full journal detail, run the Journal Entries report.